Hi Friends..

Welcome you all...

I Saw One Of My Friend Struggling With PF Withdrawal Process, So I Tried to Share the Simplest & Easiest step by step Process to Withdraw PF Online with the help of screenshots. The PF Withdrawal Process is Actually Very Easy...

So, Let's Get Started.

The First Step is to Activate your UAN... Now, What is an UAN?

UAN is an Universal Account Number and it is given to every EPF account holder.

The Next Question You'll Ask Is that How Can I Know My UAN Number?

So Let me tell You, You Can Easily Get Your UAN Number Through Your Employer, Which is the Easiest Way to Get your UAN Number. Just Contact your Agency Spokes Person & He'll Easily Provide You Your UAN Number...

Now, what If you don't get your UAN from there for some reason.. Then you have to get if from the EPFO Portal, Just go to the https://unifiedportal-mem.epfindia.gov.in/memberinterface/

On the Right Side, and You"ll Find a link "Know Your UAN". Then Click on "Know Your Status" Tab & You'll Be Directed to a new Page..

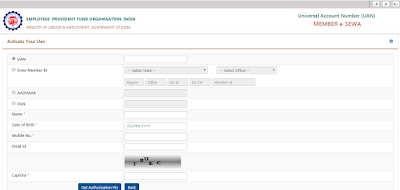

A New Page Will Appear like this...

-You Just need to Fill the Detail Here, Select State, Office From the Drop Down List, Enter Est Id, Member id (PF Id, that is Present on your Salary Slip) & Fill All other Details like Name, DOB, Mob No Etc...Click on the Get Authorization pin tab..

Enter OTP Received on the Mobile Number You Entered,

After Entering OTP, Click on Get UAN Tab.

Now, You'll Receive your UAN Number on your Mobile Number VIA SMS.

- The Next Step is to Activate UAN....

For that, Click on the ‘Activate UAN’ Tab As Shown Below..

After Successfully Activating UAN.. Enter the UAN Number and Password Received on Mobile and Reset Your Current password to the Desired One...

After that You Need to Fill Your KYC Details and Mark a mail with Screenshot to Get it Approved from Your Agency... Agency Spokes Person will then send it to the PF Team and after they approve your details, You Can Claim for PF Withdrawal.

You Need Not to Fill All The Fields.. Just Fill details of those docs Which You Have...

You Can also Check the status of your KYC Details as Shown Below.....

After Your KYC Details are successfully Updated, You Can Claim Your PF..

You Need to Fill Both Forms ( Form 19 as Well as Form-10c )One By One... Fill the details here and You'll Receive an OTP on your Registered Mobile Number...

Once You are done with all the details... You'll Get a Acknowledgement Receipt & You'll Receive the amount in Few Days in Your Bank Account.

NOTE- If Your Total Service is Less Than 6 Months, You Won't Be Able to Fill Or Rather You are not eligible to fill The Pension Form (Form 10c)

You Can Also Apply for PF Withdrawal (Advance Claim) Before Leaving Job, But There are few Restrictions...

The Maximum Amount You Can Withdraw while staying in your Job is 90% of the EPF Balance (But Only in Case of House Purchase/ Construction of House) And for that also, the minimum service duration should be 3 Years.

There are few more reasons also for which you can withdraw / Claim Advance PF.

You Can Also Check Your Claim Status As Well...

And the last Thing.....

You Can Also Transfer your PF Balance From One Company to another...

Yes, You Can Transfer your PF Balance from One Company to Another, But For That the 1st thing that you need to ensure is that your bank account should be KYC.

And For This, I'll Suggest You to Get in Touch with Your Agency Spokes Person & with the help of him, You Can Easily Transfer the PF Account Balance from one company to another.

Hope You"ll find it Helpful, Please Comment and Share with your friends/colleagues if You find it helpful.

0 comments:

Post a Comment

Thank You For Your Comment